Some people say that life is not all about money. A poor person would beg to differ. As many people have loosely quoted from The Holy Bible, “For the love of money is the root of all evil…,” —Timothy (6:10), it is not the love of money alone that creates evil. It is what you choose to do with it.

Many people have negative feelings towards the wealthy without specifically knowing what they do with their money to help others or what they had to go through to achieve such great wealth. That goes to say that it seems that the wealthy are misunderstood.

When reaching that pinnacle of financial freedom, for whatever it may be to you, it all depends on what you do with that freedom to help others who value and care about you and what you bring to the world.

That is the determination of good or evil.

What is financial freedom?

Financial freedom is the ability to have enough money to meet basic needs and live a comfortable life without having to worry about income.

It is not necessarily becoming wealthy but instead, having enough financial security that there are no worries or anxieties about where the next dollar will come from.

Being financially free gives individuals the peace of mind that whatever their current lifestyle, they will always be able to support themselves and their families.

Having financial independence allows people to make decisions based on what is truly important in life versus focusing solely on how much money can be made.

It provides the chance for individuals and families to spend time together doing activities outside of work instead of always worrying about paying bills.

It also allows people who want to take risks or pursue a passion with less fear as there is financial stability if it doesn’t turn out as planned.

What does financial freedom mean to you?

Financial freedom means something different to everyone. For some, it might mean the ability to cover their basic living expenses without worrying about money.

To others, it could mean the ability to pursue their dreams and live life on their own terms. It all depends on your personal goals and financial situation.

One of the keys to achieving financial freedom is having a solid understanding of personal finance. This includes budgeting for monthly bills, saving for retirement, investing in stocks, bonds, or real estate (if appropriate), as well as being aware of debt levels and other liabilities that can impact your long-term financial success.

It also means being mindful of how you spend your money so that you can prioritize what’s important—whether that’s paying off debt or investing in yourself—to help achieve the goals you have set for yourself.

As you can see, financial freedom means different things to different people.

Why is financial freedom important to your family?

Financial freedom is an important goal to strive for in any family.

With the ability to take care of your family, being financially free can provide peace of mind, security, and the ability to pursue dreams and goals.

The average U.S. household debt burden is more than $90,000 and rising every year, which is becoming increasingly more difficult to handle any surprise medical emergencies.

This means that the average person as well as many families are struggling with financial difficulties that can affect their quality of life as well as their prospects.

Financial planning is key for families looking to become financially free and secure a better future for all family members.

Developing a comprehensive plan for achieving financial freedom should include setting achievable goals based on income, expenses, and investments.

Having a clear idea of how much money needs to be saved each month or invested each year will help create a concrete plan of action toward reaching financial freedom faster.

Why is achieving financial freedom important to your health and well-being?

Financial freedom can have an immensely positive impact on health and well-being. When living with financial insecurity, human beings can be subject to increased stress levels, which can lead to physical and emotional issues.

Financial pressures such as debt repayment or inability to pay for basic needs can take a huge toll on mental health, leading to feelings of depression and helplessness.

The subconscious worry of having enough income has been historically shown to have an underlying impact on our overall vitality.

The lack of financial stability also affects physical health. The strain associated with worrying about money often leads people to neglect their well-being – from not getting enough restful sleep, skipping meals, or not engaging in regular exercise – resulting in poor health.

Additionally, if money is tight people may find it difficult to afford medical care when they need it and are more likely to suffer in silence rather than risk incurring further costs by seeking help.

In an article written by Purdue University, it was stated that “High levels of financial stress manifest through physical symptoms like sleep loss, anxiety, headaches/migraines, compromised immune systems, digestive issues, high blood pressure, muscle tension, heart arrhythmia, depression and a feeling of being overwhelmed.” — Purdue University

In the long run, having good financial health is one of the best things you can do to create good overall health.

How to begin creating financial freedom?

Creating financial freedom is an important goal that everyone should strive for, but you must take that essential first step.

To begin, it’s important to assess your current financial situation and create a plan to reach your goals. Start by reviewing how much debt you have and how much money you owe on personal loans, student loan debt, credit cards, etc., as your credit score can exhibit your financial leverage.

High-interest consumer loans can be one of your biggest financial concerns to conquer while on your travels to money freedom.

Eliminating credit card debt can be one of the most powerful tools in your financial arsenal when starting on your journey to monetary freedom.

Furthermore, create a budget that accounts for all of your expenses and start saving as much money as possible in a savings account.

Next, set specific savings goals with deadlines attached to them so you can track your progress toward becoming financially free.

This will help motivate you to stay the course and stay on track with achieving your goal of financial freedom.

It may also be beneficial to seek out resources such as online calculators or investment advice from professionals if needed like an accountant or financial advisor.

Ultimately, having a plan and enough savings in place will keep you organized and motivated while pursuing financial liberation.

Although most people may utilize a bank account to handle a majority of their saving efforts, always keep in mind that there are many other ways to store and keep wealth, which financial planners can help you with.

It is imperative to try to greatly reduce your finances from the consistent, heavy-handed hold of financial institutions.

For individuals who are employed and have access to a 401K system to invest funds at regular intervals, assessing the current situation with your employer’s retirement plan is an important step in achieving financial freedom.

Taking advantage of employer-sponsored retirement savings plans such as 401Ks is one of the best ways to build up financial resources.

It’s important to understand how much money you can contribute to your 401K each month. The amount that can be contributed depends on your salary, but typically it’s around 10%.

High incomes would be more beneficial to reaching your goals faster, but the average income can still reach financial security in due time.

Additionally, understanding the types of mutual funds available through your employer’s plan can help you determine which investment option is right for you.

Many employers will match a portion of employee contributions, so understanding these options is key to optimizing retirement savings.

Furthermore, taking advantage of tax breaks associated with 401K plans helps maximize returns over time and reduce taxable income.

When seeking true financial freedom, investing is also a very important strategy to include that can create long term passive income, therefore solidifying your financial goals.

Investing in the stock market or real estate can help create more wealth and increase your net worth over time.

Real estate investing allows you to utilize the power of leverage and compound interest to generate income without having to work for it.

Investing in stocks offers you a chance to grow your money with minimal risk.

Both methods have their risks, but they also offer potential rewards that are hard to ignore.

No matter what kind of investment you choose, it’s important that you do your due diligence before entering into any agreement with an outside party such as a broker, bank, or investor.

Be sure to research the options available thoroughly and understand how each method works before committing funds.

Additionally, diversifying among different types of investments can help reduce your overall risk while maximizing potential returns on investment (ROI).

How to begin increasing financial literacy?

The importance of financial freedom is that it allows you to live a life without the worry or burden of financial problems.

To achieve this, it is important to increase your financial literacy and understanding.

A good first step in increasing your financial literacy is to understand the impact money has on your everyday life and decisions.

This will help you better understand how money works, what options are available, and how best to use them.

Another important step in increasing financial literacy is setting up a budget and tracking all your spending.

This will give you an overview of where your money is going and help you prioritize how much should be saved each month for future investments or savings goals.

Additionally, it’s important to create a plan for paying off debt so that any payments made go in the right direction and aren’t just additional interest charges.

Increasing your financial awareness can make a massive, positive financial impact on your life.

One of the most potent things we can do to gain the financial know-how we desire is to study other people who have achieved great wealth and financial success.

It has been proven that when you conduct certain activities regularly, your mind tends to create subconscious habits and patterns related to those activities.

Learn From The Greats

Financial freedom is something that many people strive for, and it can be achieved through a variety of methods.

One such method is the act of continually immersing yourself in the knowledge of others who have arrived at the point you wish to reach.

Learning from those with more experience in achieving financial freedom is an important step towards becoming financially free yourself.

Legendary, long time investor Warren Buffett once said, “Risk comes from not knowing what you’re doing.” This idea speaks to the importance of constantly learning from those who have been successful in reaching financial freedom.

By listening to stories and advice from individuals who have reached their goals, you will gain insight into how they achieved success.

You may learn strategies or techniques on budgeting or investing that are effective and can be applied to your situation.

Achieving financial freedom is not only desirable, but it is a duty that individuals must take on if they want to be successful in life.

Many people think that money can buy happiness and while this may be true to an extent, it is important to realize that personal financial freedom should always come first.

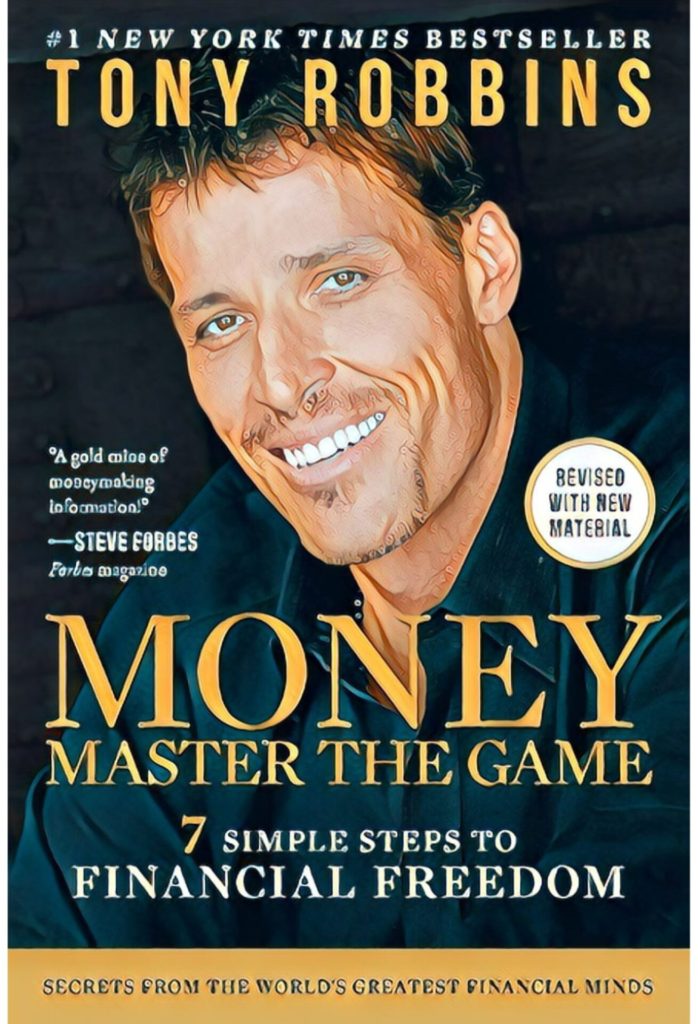

One of the best ways to achieve this goal is by mastering the game of money.

Tony Robbins, author of Money: Master The Game (7 Simple Steps to Financial Freedom) and one of the world’s leading experts on personal finance and success, has outlined some effective strategies and techniques for budgeting and investing that can help individuals achieve financial freedom.

From automating expenses and setting up a solid emergency fund to diversifying investments, Robbins offers comprehensive advice on how to make smart financial decisions with long-term benefits in mind.

While on your odyssey of quelling your financial constraints to place you and your family in a better financial position, it can be very beneficial to visit the works of someone like Tony Robbins.

For decades, Tony has been helping millions of people turn themselves into better versions of themselves, starting with the way they think.

Tony’s teachings may help you become a financially free person as well as a mentally free person.

What are other possibilities after becoming financially free?

Once a person has achieved financial freedom, it opens up many other possibilities.

A debt-free life provides the opportunity to make decisions that are based on personal values and interests rather than financial necessity.

With no worries of debt or loans, one can choose to pursue their dreams and goals without any limitations.

Life decisions like creating financial freedom also give individuals the ability to create multiple streams of income.

Without the burden of loan payments, people can use their extra funds for investments or start a new business venture.

The result of hard work and dedication is often greater opportunities than before becoming financially free.

A Stream Of Income To Further Grow Your Wealth and Freedom: Private Lending

Once some people reach the goal of becoming financially free, the good news is that they realize the potential of growth opportunities to help other people grow their wealth.

Becoming a private lender can be a good idea and is one avenue that places you on the right track to growing your wealth exponentially.

The good thing about becoming a private lender, for example, is that it allows you to supply real estate investors with the amount of money they need to close deals, help a business owner who may have financial troubles stay in business, or any other unique situation where money can be of great assistance, all while setting your own interest rates of return.

Financial freedom also allows individuals to execute retirement planning at an earlier age so that they have more time and resources to enjoy in their later years.

Furthermore, with financial security comes peace of mind which leads to better physical and mental health as well as improved relationships with family and friends.

Conclusion

The true way to achieve financial freedom is to make sure your income exceeds your expenditure.

This will enable you to save and invest more money over time so that your wealth can grow and increase your financial security.

Additionally, cutting down on unnecessary expenses and creating a budget plan can help you manage your finances better and stay out of debt.

Attaining financial freedom is an important goal for everyone.

Good financial management and spending habits are the keys to becoming financially free.

It might not be easy, but it’s worth it in the end, as being financially secure allows you to better enjoy life.

Overall, achieving financial freedom is a dutiful process that not only helps you but helps others and requires hard work and dedication from individuals who are willing to take control of their finances to create a brighter future for themselves and their families.